The basics of establishing and creating a business is different from the basics of ensuring that it continues to run and stay afloat. One key aspect of a business is a cash flow forecast, and without it, you may as well close down shop right here and now.

Let’s first dive into the details as to what a Cash Flow Forecast is. A business cash flow forecast is a business document or part of a business plan where it estimates the amount of money a business could bring into their everyday transactions, and how much they are expecting to spend on their everyday expenses as well. It is a document that includes all of a business’ forecasted income and expenses and is usually itemised. A cash flow forecast usually takes into consideration the next 12 months, but it can also only look ahead up to a few weeks or even just a few months, depending on how and why the business needs it.

So why is this important? This is because the cash flow forecast of a business acts as a sort of warning system, much like how weather can be forecasted, a business can also look forward to its expected cash flow for the next few months based on an analysis of several details that come from a business’ day to day transactions.

A business’ cash flow forecast will also track how fast or how slow a business’ customers are paying their credits or invoices. For businesses that involve wholesales, this is something that is important due to the fact that most wholesale businesses depend on the profits of their orders, making on time payments, very much important.

A cash flow forecast will also tell any business owner if their business will have enough cash to be able to expand their business. The business owner can also expect that the forecast will also tell them how much cash is needed to keep the business running. It will also be able to show a business owner if and when there is more cash going out of their business than cash going in.

And lastly, while we may not have been able to give every reason why a cash flow forecast is important, a cash flow forecast can be used to find cycles in payment or trends that are seasonal in order to be able to find or pinpoint moments in a business calendar year when a business may need additional cash for the daily expenses and payments a business goes thru. This can help any business be able to plan ahead and make sure that it always has money to cover such expenses or payments.

With all that being said, and most bases of why a business needs a cash flow forecast almost covered, let’s head on to how a business can make and ensure that its cash flow forecast is correctly done.

STEP 1: Estimation of a business’ income in a specific period of time

Any business looking to make their business cash flow forecast should take a look at their sales over the last 2 to 3 years. They can then use this as their basis for their calculations in their cash flow forecast.

Remember that not all sales and income patterns will be the same, this means that there should be other factors that should be considered when you’re making your forecast. The holiday seasons, your marketing campaigns, trade shows, events, and even new product launches should be considered.

A business’ next step should be to have an estimation of the amount of money that they are expecting to earn over that particular period, keeping in mind all of the factors that will and can come into play. This also includes loans and investments that a business is going to get or is expected to get.

While past sales records are important, a business can still make predictions based on a survey of your customers needs and purchase requirements along with their intentions of purchase especially if the business does not have access to any previous financial records or reports. This way the business will have an idea how much money will be coming into the business.

STEP 2: Know when you’re getting paid

A business should know when it is going to get paid in order to know if they will have enough money for the upcoming days, weeks, or months. For businesses that are not retailers, this is extremely important because money doesn’t come at a regular basis, which means a business needs to consider the terms of payment to be able to procure an accurate cash flow and be able to set it against any outgoing money.

STEP 3: Know your expenses

One important column in your cash flow forecast should be your expenses. This should be a very detailed column as it will determine whether or not a business has any shortages for the upcoming days, weeks, or even months. This in turn will allow a business to estimate the bills they would have to pay and decide on their day to day costs.

There are a lot of expenses that are already fixed for a business that they must ensure are in their expenses column, and some of these may be:

- Rent

- Materials (Raw / Processed)

- Assets

- Salaries

- Loans, fees, and other charges

- Taxes

- Marketing and advertising expenses

STEP 4: Compiling and Working out your Cash Flow Forecast

The next step is to compile the Cash Flow Forecast with the business details collected from the above steps. Subtract the business’ net expenses or outgoings from the business’ net income which will give the business either a positive or negative figure. If your cash flow forecast results in a positive figure, this means that the business has more cash coming into it than what it is spending on expenses. Similarly, when it is a negative figure, this means that the business is spending more money than what it is earning.

The business then has the option to keep an eye out on the running total of the cash flow forecast, from weeks to even months, in order to get a clear picture of the business’ cash flow forecast for the business in the upcoming months; a lot of negative weeks can mean that the business is in trouble and it needs a lot of forward planning in order to meet commitments. Equally, positive weeks can mean that the business can either choose to expand or invest in some other aspect of the business.

STEP 5: Finalize the budget and adjust as needed

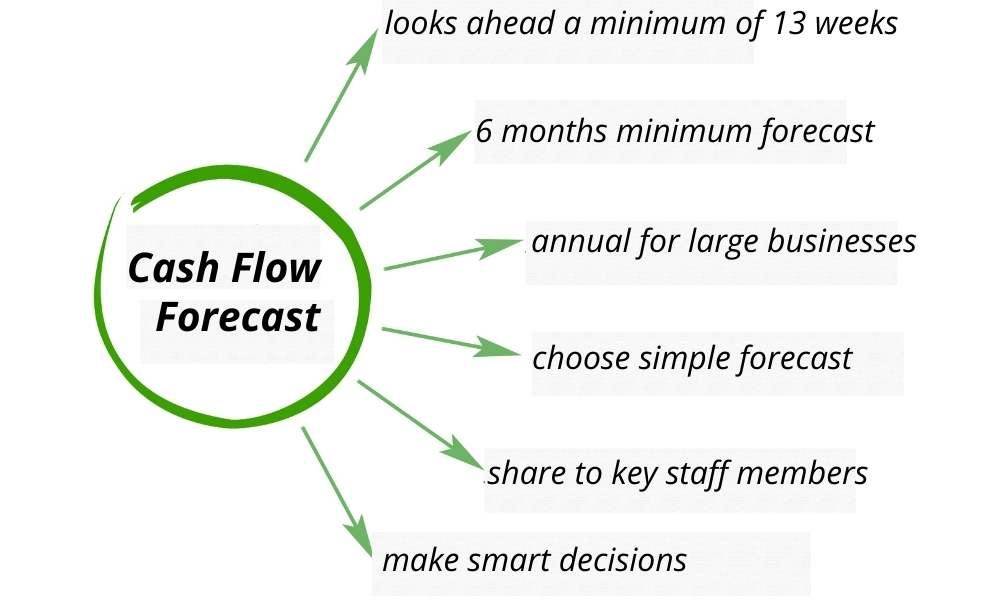

The main goal of a business in order to make a Cash Flow Forecast is to ensure that the business is making smart decisions when it comes to their expenditures. This means that with the completion of the business’ cash flow forecast, a business will be able to make smart decisions on where to invest or expand in the business, or if it needs to double up on its effort to make sure that there is an increase in the cash that comes into the business.

A business will be able to make its annual budget in a more efficient way when it is partnered with an updated Cash Flow Forecast. And while the 5 steps above are a sure fire way to make a Cash Flow Forecast here are a few things you can keep in mind when making one as well:

It is always best to make a cash flow forecast that looks ahead a minimum of 13 weeks. Those 13 weeks into the future is for the reason that most businesses do not and will not have enough financial capabilities to survive a cash flow crisis (when there is no money entering the business), be it short term or long term. On the other hand, six months minimum should be the cash flow forecast prepared, and for really large businesses, an annual cash flow forecast should suffice for the business.

Remember that a business should always choose the simplest of cash flow forecasts. It does not need to be that fancy, as the data in a business document like this one will be read by various people in the company, meaning, the more simple it is to understand, the better key staff members will be able to tackle all of the things needed to be done in order to improve or maintain, a business’ cash flow.

And finally, a business must always remember to share their cash flow to key staff members who can help achieve the goals that a business needs to achieve or what a business aims to do or implement in order to fix or correct the flow of income into the business

A business’ success can lie in successfully being able to find a balance between profit making and being able to effectively manage cash flow. Hence, Cash flow management is the center of any success of a business, and making a cash flow forecast is the key to having the best cash flow management in any business.

NEED FUNDING FOR YOUR BUSINESS? GET A FREE QUOTE TODAY AND GET FUNDED!

CLICK HERE TO GET A FREE QUOTE

Share this article