Unlocking capital for your property can be a game-changer when it comes to growing your business or investing in real estate. Business loans for property provide a valuable financing option that can help you secure the funds needed to purchase or expand your property portfolio. By understanding the various property financing options available and the factors to consider before applying for a loan, you can make informed decisions that align with your financial goals.

Here is a breakdown of the key points to consider:

Understanding Property Financing Options: There are different types of property financing options available, including conventional mortgage loans, commercial mortgage loans, and SBA loans. Each option has its own eligibility criteria, loan terms, and requirements.

Benefits of Business Loans for Property: Business loans for property offer several benefits, such as providing access to a substantial amount of capital, allowing for property acquisition and expansion, and offering tax benefits and favorable interest rates.

Factors to Consider Before Applying for a Business Loan: Before applying for a business loan for property, there are several factors to take into account. These include your credit score and financial history, property evaluation and appraisal, business plan and projections, and loan terms and interest rates.

How to Apply for a Business Loan for Property: Applying for a business loan for property involves a step-by-step process, including gathering the necessary documents, completing the application, and working closely with lenders or financial institutions.

Common Challenges and Solutions: While obtaining a business loan for property can be advantageous, it does come with its own set of challenges. These can include down payment requirements, the loan approval process, and managing cash flow and debt service. By being aware of these challenges and strategizing accordingly, you can overcome them.

By familiarizing yourself with these key aspects of business loans for property, you can unlock the potential for growth and financial success in the real estate market. Whether you are a business owner or an investor, understanding the ins and outs of property financing options and the application process will empower you to make the best choices for your property ventures.

Key takeaway:

- Unlocking capital for property: Business loans provide a means to secure funding for property investments, enabling individuals to take advantage of real estate opportunities.

- Understanding financing options: Conventional mortgage loans, commercial mortgage loans, and SBA loans are among the available options for property financing, each with its own advantages and considerations.

- Benefits of business loans: Business loans for property offer benefits such as flexibility, tax advantages, and the potential for property appreciation, making them an attractive choice for investors.

Understanding Property Financing Options

When it comes to unlocking capital for your property, understanding the various financing options is crucial. In this section, we’ll explore the world of property financing, diving into conventional mortgage loans, commercial mortgage loans, and SBA loans. Get ready to embark on a journey that will equip you with the knowledge and insights you need to make informed decisions about your property investments. So, let’s dive in and discover the financing options that can help turn your property dreams into reality.

Conventional Mortgage Loans

Conventional mortgage loans are a popular financing option for property purchases. They are provided by financial institutions like banks and credit unions and are backed by the purchased property. Here are some key points to consider:

- Qualification requirements: To be eligible for a conventional mortgage loan, borrowers typically need a good credit score, stable income, and a low debt-to-income ratio. Lenders also consider factors like property value, loan amount, and the borrower’s financial history.

- Down payments: Conventional mortgage loans usually require a down payment, which is a percentage of the property’s purchase price. The exact amount depends on the lender and the borrower’s financial situation. A down payment of 20% or more can help borrowers avoid private mortgage insurance (PMI) and get better loan terms.

- Interest rates: Conventional mortgage loans often have competitive interest rates compared to other loans. The interest rate can vary based on the borrower’s credit score, loan term, and market conditions. Borrowers should shop around to secure the best possible rate.

- Loan terms: Conventional mortgage loans typically have fixed interest rates and monthly payments, making long-term budgeting easier. The loan term can vary, with common options being 15 or 30 years. Shorter terms have higher monthly payments but result in lower overall interest paid.

- Downside protection: Conventional mortgage loans provide certain protections. If the borrower defaults, the lender can foreclose on the property. Borrowers have rights and can explore options like loan modifications or refinancing to avoid foreclosure.

- Alternative options: While conventional mortgage loans are popular, there are other financing options available. Government-backed loans like FHA loans and VA loans have specific eligibility criteria. Borrowers should evaluate all options to find the best fit for their financial situation and goals.

Commercial Mortgage Loans

Commercial mortgage loans are popular for businesses seeking to finance property investments. Consider these important factors when exploring this option:

– Property Evaluation: Thoroughly evaluate the property before applying for a loan. Assess its condition, location, and potential for growth.

– Loan Terms and Interest Rates: Carefully review and compare terms and rates to choose the best option for your business.

– Financial Records: Provide detailed financial records to demonstrate your business’s stability and ability to repay the loan.

– Market Size: Consider population growth, economic development, and competition in the area where your property is located.

– Property Maintenance: Factor in the cost of regular maintenance and repairs for your commercial property.

– Equity Funding: Have sufficient funds for a down payment or equity investment required by lenders.

– Cash Flow: Assess the potential income from the property to ensure timely loan repayments and cover ongoing expenses.

– Specialized Properties: Make sure the lender understands the unique characteristics and requirements of specialized properties.

– Alternative Finance Options: Explore other financing options such as private lending, asset-based lending, or partnerships with established businesses.

These factors are crucial when applying for a commercial mortgage loan. Careful evaluation will help you make an informed decision and secure the financing needed for your business’s property investment. Consult with financial institutions, mortgage brokers, or private investors to find tailored financial solutions that suit your business’s needs.

SBA Loans

When it comes to property financing, SBA loans can be a practical option. Consider the following:

– Flexible Terms: SBA loans offer flexible repayment terms to meet your specific needs.

– Competitive Rates: SBA loans provide competitive interest rates for your property financing.

– Streamlined Application Process: The SBA simplifies the loan application process for efficient access to funds.

– Tailored Funding Options: SBA loans are available for property investment, restoration, and preservation.

– Partnering with Established Businesses: Approval for SBA loans often requires partnering with established businesses, offering valuable mentorship.

– Alternative Finance Options: SBA loans are a viable alternative for businesses unable to qualify for traditional financing.

– Sizeable ABL Line of Credit: With an SBA loan, access a sizeable asset-based lending (ABL) line of credit for property investment or expansion.

– Raising Capital: SBA loans are effective for raising capital for property investments.

– Business Plan and Projections: Qualify for an SBA loan by providing a comprehensive business plan and financial projections.

– Property Evaluation and Appraisal: Lenders require a thorough evaluation and appraisal of the property for SBA loans.

Consider these factors to determine if an SBA loan is the right choice for your property financing needs. Research and compare lenders to find the best terms and rates for your situation.

Benefits of Business Loans for Property

Benefits of Business Loans for Property

- Access to capital: Business loans for property provide the necessary funds for investing in or expanding a property, whether it’s purchasing a new property, renovating an existing one, or developing land.

- Flexibility: Repayment options for business loans for property are flexible, allowing borrowers to choose the option that suits their financial situation and helps manage cash flow.

- Low-interest rates: Business loans for property often have lower interest rates compared to other types of loans, resulting in significant cost savings over time and making it a more affordable financing option.

- Tax advantages: Business loans for property offer tax advantages, with the interest paid on the loan being tax-deductible, reducing the overall tax liability for the property owner and improving the property’s financial performance.

- Property appreciation: Investing in a property using a business loan can lead to property appreciation over time, increasing equity and potentially allowing for profitable property sales in the future.

- Opportunity for growth: Business loans for property allow business owners to expand their real estate investments and increase revenue streams, leading to overall profitability.

To maximize the benefits of business loans for property, it is important to carefully consider the loan terms and conditions, as well as the financial feasibility of the investment. Thorough market research, evaluation of property value trends, and working with a trusted lender are crucial for a successful venture. Maintaining a strong credit profile and providing a solid business plan can improve the likelihood of loan approval and better terms from lenders. By leveraging the benefits of business loans for property, individuals and businesses can unlock the potential of their real estate investments and thrive in the property market.

Factors to Consider Before Applying for a Business Loan

Considering all the necessary factors is crucial before diving into the realm of business loans for your property. From your credit score and financial history to the evaluation and appraisal of your property, each element plays a vital role. Crafting a solid business plan with accurate projections and understanding the terms and interest rates of the loan are equally important. Let’s explore these factors in more detail to unravel the secrets behind successfully unlocking capital for your property.

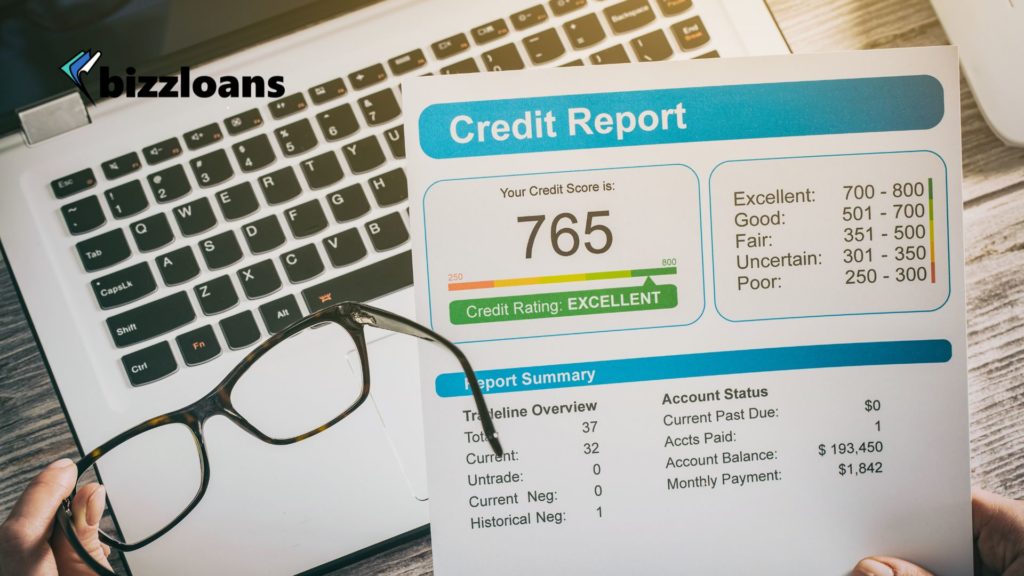

Credit Score and Financial History

When applying for a business loan, your credit score and financial history are vital factors that determine your eligibility and loan terms. It is essential to have a good credit score to enhance your creditworthiness and secure a lower interest rate. Aim for a credit score of 700 or above to increase your chances of loan approval with favorable terms.

Lenders also review your payment history to assess if you make timely payments. Missed or late payments can adversely affect your credit score and reduce the likelihood of loan approval.

Lenders evaluate your ability to repay the loan by assessing your debt-to-income ratio. This ratio compares your monthly debt payments to your monthly income. Aim for a low ratio to show that you can manage additional loan payments.

If you have a history of bankruptcy or foreclosure, it can significantly impact your credit score and make it more challenging to secure a business loan. Be prepared to explain the circumstances and demonstrate financial recovery.

In addition to your personal credit history, lenders also evaluate your business’s financial history. They review income statements, balance sheets, and cash flow statements to assess your financial stability and repayment ability.

Lenders also consider your outstanding loans and financial obligations to ensure you have enough income to cover all your current debts and the new loan.

Having a good credit score and solid financial history increases your chances of loan approval and favorable terms. It shows lenders that you are a responsible borrower who can be trusted to repay the loan on time.

Businesses with a positive credit history are historically more likely to secure business loans successfully. Lenders look for borrowers with strong financial backgrounds and a history of responsible financial management to minimize the risk of default. Establishing and maintaining a good credit score is crucial for accessing not just business loans, but also other financial opportunities in the future.

Property Evaluation and Appraisal

During the process of obtaining a business loan for a property, one crucial step is property evaluation and appraisal. This step determines the value of the property and assesses its potential as loan collateral. Here are some factors to consider during the property evaluation and appraisal process:

- Expertise of Appraisers: Qualified and experienced appraisers who specialize in commercial properties assess the property’s condition, location, size, and other unique characteristics to determine its market value accurately.

- Comparable Sales: Appraisers use recent sales of similar properties in the area to establish a baseline value. They analyze factors like property size, location, condition, and amenities to identify comparable sales and make an informed evaluation.

- Income Potential: For income-generating properties, appraisers examine the property’s potential to generate revenue through rents or leases. This includes evaluating current rental rates, occupancy rates, and projected income based on market trends.

- Physical Condition: The appraiser inspects the property’s structure, systems (such as electrical and plumbing), and overall maintenance. Any significant repairs or necessary upgrades may affect the property’s value.

- Market Analysis: Appraisers assess local market conditions, including property supply and demand, vacancy rates, and comparable sales data. This analysis helps determine the property’s value in relation to market trends.

- Property Zoning and Regulations: Appraisers consider zoning restrictions, building codes, or other regulations that may affect the property’s value or potential use. Compliance with local ordinances is essential.

- Environmental Factors: Environmental assessments identify potential hazards or contamination that could impact the property’s value and potential use. Appraisers consider these assessments during the evaluation process.

By carefully evaluating and appraising the property, lenders can determine its value and the level of risk associated with the loan. This information helps them make informed decisions regarding loan terms, interest rates, and financing amounts.

A business owner, John, needed a loan to expand his construction company and purchase a new property. During the appraisal process, the appraiser discovered that the building required significant repairs and outdated infrastructure. As a result, the initial appraisal value was lower than expected.

However, John worked with the appraiser to provide detailed plans for property restoration and modernizing production processes. These plans showcased the property’s potential and highlighted the value it would bring to his business. After considering John’s plans, the appraiser recognized the strategic location and unique characteristics and appraised the property at a higher value.

This increased appraisal value played a crucial role in securing the necessary loan for John’s business expansion. The thorough evaluation and appraisal process allowed the lender to understand the property’s potential and provide tailored financial solutions to support John’s capital investment.

Business Plan and Projections

When applying for a business loan for the property, a comprehensive and well-executed business plan, and accurate financial projections are absolutely vital.

- A meticulously detailed business plan: Outline clear objectives, effective strategies, target market analysis, and precise financial projections. Showcase how the property will significantly contribute to growth and profitability. Include relevant information about the industry, competitors, and marketing strategies.

- Accurate and data-driven financial projections: Provide realistic and well-substantiated projections for revenue, costs, and expenses for both the property and overall business operations. Collaborate with a financial professional to ensure accuracy and reliability.

- Strong market analysis: Conduct a thorough and comprehensive analysis to fully grasp the demand for the property and its growth potential. Evaluate and analyze market trends, competition, and customer preferences. By doing so, you will be able to project the property’s performance and ascertain its viability.

- Demonstrate a clear return on investment (ROI): Emphasize how the property generates a considerate return on investment. Provide estimations of rental income, occupancy rates, and potential appreciation. Display a profound understanding of the property’s income potential and its alignment with your business goals.

- Provide essential supporting documentation: Include pertinent documents such as contracts, leases, financial statements, tax returns, and records that showcase your business’s financial health and stability.

Pro Tip: It is crucial to regularly review and update your business plan and projections as your business and property evolve. This practice will help you stay on track and adapt strategies accordingly.

Loan Terms and Interest Rates

| Loan Term | Interest Rate |

| Short-term loan | 7% |

| Medium-term loan | 5% |

| Long-term loan | 4.5% |

| Fixed interest rate | 3.5% |

| Variable interest rate | 5% |

Loan terms and interest rates are important factors to consider when getting business loans for property. They can significantly affect repayment cost and duration. Here are key points about loan terms and interest rates:

1. Short-term loan: Less than one-year duration with a 7% interest rate. Suitable for businesses needing quick cash loans for immediate expenses.

2. Medium-term loan: One to five years duration with a 5% interest rate. Used for capital expenditure budgets or property preservation projects.

3. Long-term loan: More than five years duration with around a 4.5% interest rate. Used for long-term property investments or large-scale projects.

4. Fixed interest rate: Maintains a consistent interest rate throughout the loan term, typically around 3.5%. Provides stability for budgeting.

5. Variable interest rate: Interest rates fluctuate based on market conditions. Starting rate is usually lower, but there is a risk of increasing rates in the future, generally around 5%.

It is crucial to consider the specific loan terms and interest rates that best suit your business needs. Assess your financial records, market size, and property maintenance requirements to determine the most favorable loan option. Work with financial institutions, mortgage brokers, or private investors to explore tailored funding options and secure competitive rates. Partnering with established businesses or asset-rich companies can help enhance your loan terms and interest rates.

To illustrate the impact, let’s consider the story of ABC Trucking. They needed capital to buy new trailers and applied for a long-term loan with a fixed interest rate of 3.5%. This allowed them to raise the necessary capital while keeping their monthly payments affordable and predictable. As a result, ABC Trucking expanded its distribution business and boosted profitability.

How to Apply for a Business Loan for Property

To successfully apply for a business loan for property, you need to follow these steps:

- Research lenders and loan options. Compare rates, terms, and conditions to find the best fit.

- Know your credit score. Request a copy of your credit report and improve it if necessary.

- Prepare financial statements, including income statements, balance sheets, and cash flow statements.

- Create a compelling business plan that showcases your objectives, strategies, and financial projections.

- Gather information about collateral, such as the property or other valuable assets.

- Create a comprehensive loan proposal that outlines the purpose, amount, terms, and planned usage of funds.

- Follow the lender’s instructions to submit your loan application.

- Review offers and negotiate terms, if required.

- Promptly provide any additional documents requested by the lender.

- Finalize the loan agreement, ensuring a clear understanding of all terms and conditions.

Applying for a business loan for property can be a complex process, but by following these steps, you can increase your chances of obtaining the funding you need.

John Doe serves as a great example of success in this field. He transformed a run-down industrial property into a thriving commercial center. With thorough research, a comprehensive business plan, and well-prepared financial statements, Doe successfully secured a favorable loan. The obtained funds enabled him to renovate the property, attract tenants, and create a vibrant community hub. This inspiring success story motivates aspiring entrepreneurs who intend to leverage the power of business loans for property.

Common Challenges and Solutions

Running a property business comes with its fair share of challenges, but fear not, we’ve got solutions! In this section, we’ll dive into the common hurdles property owners face and the ways to overcome them. From navigating down payment requirements to streamlining the loan approval process, and even managing cash flow and debt service, we’ll provide you with practical insights and tips to unlock capital for your property ventures. Say goodbye to obstacles and hello to success!

Down Payment Requirements

When obtaining a business loan for a property, it is essential to understand the down payment requirements. Here are some factors to consider when determining the amount of down payment you will need:

1. Loan-to-Value Ratio: Lenders typically require a down payment based on a percentage of the property’s value. For example, if a lender requires a 20% down payment and the property is valued at $500,000, you would need to provide $100,000 as a down payment.

2. Property Type: Different property types may have varying down payment requirements. Commercial properties may require a larger down payment compared to residential properties.

3. Financial Strength: Lenders consider your financial strength when assessing down payment requirements. They may require a larger down payment if your credit score, financial history, or income does not meet their criteria.

4. Loan Program: Different loan programs have different down payment requirements. Conventional mortgage loans generally require larger down payments compared to government-backed loans such as those offered by the Small Business Administration (SBA).

5. Private Investment: In some cases, you may be able to secure a business loan for a property with a lower down payment by bringing in private investors or partners who contribute additional capital.

6. Lender’s Requirements: Each lender may have its specific down payment requirements. It is crucial to shop around and compare offers to find a lender that best suits your needs.

Pro-tip: Before applying for a business loan, carefully review the down payment requirements of different lenders and loan programs. Consider factors like your financial strength, property type, and the loan-to-value ratio to determine the amount of down payment you need to secure financing for your property purchase.

Loan Approval Process

The loan approval process for business loans for property involves several steps:

1. Initial evaluation: The lender assesses the borrower’s credit score, financial history, and business plan to determine eligibility. They also consider the value and potential of the property being financed.

2. Documentation submission: The borrower provides financial records such as tax returns, bank statements, and profit and loss statements. These documents help the lender verify financial stability and ability to repay the loan.

3. Property evaluation and appraisal: The lender assesses the property’s value and whether it meets lending criteria. They may request an appraisal to ensure the property’s worth matches the loan amount.

4. Reviewing loan options: The lender analyzes the borrower’s loan requirements and financial records to determine the most suitable loan. They consider interest rates, repayment terms, and term flexibility.

5. Loan underwriting: The lender assesses creditworthiness and loan eligibility based on financial records, business plan, and collateral. This step involves a detailed analysis of the borrower’s financial situation and ability to repay the loan.

6. Loan approval: If the borrower meets all criteria and the property evaluation is satisfactory, the loan is approved. The lender provides a loan offer with terms and conditions.

7. Loan closing: Once the borrower accepts the loan offer, the lender prepares necessary documents for closing, including legal agreements, loan disclosure statements, and additional documentation.

8. Funding: After loan closing, the lender disburses the approved loan amount. The funds can be used for the intended purpose, such as purchasing a property or funding improvements.

Borrowers should be prepared for the loan approval process. By organizing financial records, maintaining a good credit score, and developing a well-researched business plan, borrowers can increase their chances of approval. Partnering with established businesses or having sufficient collateral can also boost approval chances. Flexibility in terms and competitive rates enhances the loan approval process.

Managing Cash Flow and Debt Service

Managing cash flow and debt service is crucial for businesses that have taken out loans for property. By effectively managing these aspects, businesses can ensure smooth financial operations and avoid complications. Here are some strategies for managing cash flow and debt service:

- Create a cash flow forecast: Project your expected cash inflows and outflows to anticipate potential shortages and plan accordingly. This will inform how you allocate funds and meet debt obligations.

- Monitor and control expenses: Regularly review expenses to identify areas for cost-cutting or reduced spending. This will preserve cash and cover debt payments.

- Establish a debt repayment plan: Prioritize payments based on interest rates and due dates. Pay off high-interest debts first to minimize long-term interest payments. Stick to the plan and avoid late or missed payments.

- Maximize cash inflows: Explore ways to increase revenue and cash inflows. This can include implementing marketing strategies, offering new products or services, or renegotiating contracts with suppliers to improve profit margins.

- Build an emergency fund: Set aside a portion of cash flow as an emergency fund to cover unexpected expenses or temporary shortages. This provides a financial buffer and reduces the need for additional borrowing.

- Communicate with lenders: Promptly communicate with lenders if you anticipate difficulties meeting debt obligations. They may be willing to find a solution, such as debt restructuring or adjusting repayment schedules.

- Review and optimize debt structure: Periodically review your debt structure to align with business goals and financial situation. Consider refinancing options for better terms or cash flow relief.

Implementing these strategies allows businesses to effectively manage cash flow and debt service, maintaining financial stability in property financing.

Some Facts About Unlocking Capital for Your Property: An Intro to Business Loans for Property:

- ✅ Private lending in Australia is a solution for financing specialized properties that may face challenges in obtaining funding from traditional sources. (Source: Our Team)

- ✅ Traditional banks and financial institutions may hesitate to provide funding for properties with limited market demand or unique characteristics. (Source: Our Team)

- ✅ Private lending offers an alternative approach, allowing borrowers to tap into alternative sources of capital. (Source: Our Team)

- ✅ Private lenders like Archer Wealth in Australia provide flexible financing solutions, specializing in asset-based lending and offering short-term loans backed by property assets. (Source: Our Team)

- ✅ Private lending is a viable option for individuals with less-than-perfect credit, as the focus is on assessing the property’s value rather than scrutinizing the borrower’s credit history. (Source: Our Team)

Frequently Asked Questions

FAQs – Unlocking Capital for Your Property: An Intro to Business Loans for Property

1. What is asset-based lending (ABL) and how does it work?

Asset-based lending (ABL) is a financing option suitable for companies with significant assets that may face fluctuations in cash flow. It provides capital to operate and expand by utilizing those assets as collateral. A broad range of businesses, including trucking firms and manufacturers, can benefit from ABL.

2. How can asset-based lending help property preservation businesses?

Property preservation businesses can utilize asset-based lending to secure financing for various aspects such as property inspection, management, maintenance, and restoration. ABL provides the necessary capital for expansion, improvements, and investment opportunities in this growing industry.

3. How does private lending provide financing options for specialized properties?

Private lending in Australia offers an alternative approach to financing specialized properties that may face challenges in obtaining funding from traditional sources. Trusted providers like Archer Wealth offer flexible financing solutions, particularly asset-based lending backed by property assets. This allows borrowers to secure quick cash loans without lengthy approval processes, making it suitable for individuals with less-than-perfect credit.

4. What financing options are available for property preservation businesses?

Property preservation businesses have various financing options to consider. Traditional bank loans and Small Business Administration (SBA) loans offer low interest rates and reasonable loan amounts but have stricter eligibility requirements. Crowdfunding, real estate investment, and franchising opportunities are alternative ways to raise capital. Each option has its pros and cons, and a comprehensive business plan is crucial to attract investors and secure financing.

5. How can business loans for property support the modernization of production processes?

Business loans for property, such as asset-based lending, can provide the necessary capital for companies, including manufacturers, to modernize their production processes. These loans ensure companies have access to capital even during economic downturns, allowing them to weather the dips, reduce orders, and continue their operations while adapting to new fuel efficiency regulations and other industry changes.

6. How can businesses benefit from continuous improvement with the help of asset-based lending?

Asset-based lending allows asset-rich companies to continuously improve their operations, especially during challenging times. By providing quick access to capital, businesses can invest in operational enhancements, such as developing an online presence, adopting new technologies, and adapting to changing market demands. This flexibility supports businesses in optimizing their efficiency, competitiveness, and long-term success.