Business Loan Calculator | Calculate Loan Repayments and Costs

Worry less about your loans! We got you covered!

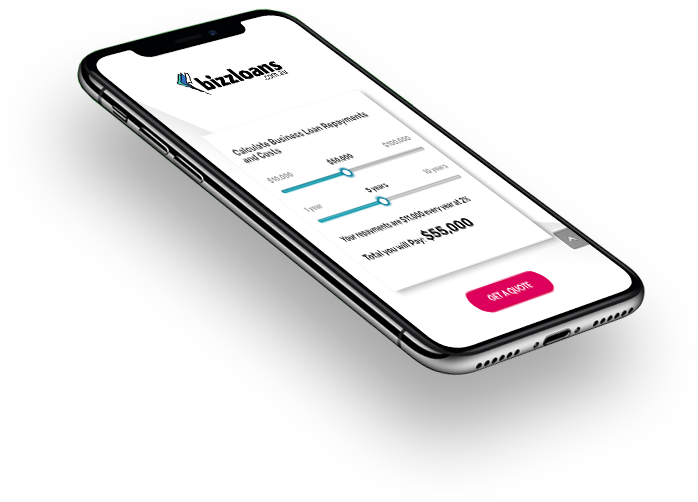

Are you a business owner looking for a loan? Then before anything else, use our business loan calculator! A business loan calculator helps a business owner to not only decide on getting a business loan from us but also show them what the repayment scheme may look like! From the start to the end, we will reveal all of the cost that our business loans have, with no hidden fees sneaked in!

Get to know just how much your business, no matter how small, can borrow from us! Use our very own free business loan calculator to get information about the total cost of the loan that you want to apply for. We’ll give out all the options for the repayment scheme and offer you a glimpse of various interest rates, all within one click of a button! Make sure to also check your inbox for a test payment schedule depending on the loan that you checked out with our business calculator. This business loan calculator for Australia is completely and absolutely free to use, and a business owner like you can use it for as many times as you would like!

HOW MUCH WOULD A BUSINESS LOAN COST WITH US?

Easy. Our loans have a 2% fee annually and that’s it! A business will simply have to pay back how much the principal of their loan is and the interest that comes with it. Use our business loan calculator UK in order to determine how much the interest is in the loan principal that your business would like to borrow.

ARE THERE ANY EXTRA FEES?

We do not have any extra fees, and we do not have any hidden charges.

Some other types of business loans and even credit cards from other banks or financial institutions have hidden charges, ours however does not. We do not even have any penalty for early repayment of the principal that you owe us, no direct debit fees, or even ongoing fees. What we charge are interest rates that are fixed and our annual fee. For us, your business would not incur any surprise expense that can be unwelcome and difficult for your business to pay off and can affect its cash flow.

WHAT ARE OTHER BUSINESS LOAN CHARGES AND FEES DOES MY BUSINESS HAVE TO EXPECT OR LOOK OUT FOR FROM OTHER BANKS OR FINANCIAL INSTITUTIONS?

There are several fees that your business should look out for when applying for small business loans from banks or other financial institutions, here are some of them:

Application Fees: This fee is payment upfront upon application of the loan, and does not guarantee that your loan will be approved, which means that it is a fee that is payable whether or not the application for the business loan is approved or not.

Direct Debit Fees: These are fees where the bank or the financial institution would charge extra fees everytime the business makes a payment for the principal borrowed. While it may seem as if it is only a small fee, however, if all put together, can still add into a pretty big and hefty sum, hundreds to even thousands of dollars.

Early Repayment fees: A lot of businesses can be surprised to find that they already have the funds in order to make early repayments to the principal that they loaned.

A lot of banks and financial institutions have a penalty for those that want to pay off their principal amounts early. A lot of banks and financial institutions in Australia actually charge penalty fees for paying early.

Remember that as a business owner, you need to read everything, up to the littlest fine print in order to know all the twists and turns that your loan term and conditions have should your business want to pay off the principal amount a little early.

FACTORS AFFECTING BUSINESS LOAN REPAYMENTS

When calculating business loans repayments for a business, several factors come into play. These factors can significantly influence the total cost of borrowing and the structure of repayments.

Understanding these factors is crucial for business owners to make informed decisions when obtaining financing and managing their loan repayments. The key factors affecting monthly repayments include:

A. Principal amount

The principal amount is the initial sum of money borrowed from a lender. This amount directly affects the overall size of monthly repayments.

Generally, a larger principal amount results in higher repayments, while a smaller principal amount leads to lower repayments. The principal amount is gradually reduced as the borrower makes repayments over the loan term.

B. Interest Rate

This is the cost of borrowing money, expressed as a percentage of the principal amount. Lenders charge interest as compensation for providing the loan and to account for the risk associated with lending money. This can be fixed or variable:

- Fixed: Remains constant throughout the loan term. This means that the borrower’s interest payments stay the same, providing stability and predictability in repayment amounts. Fixed rates are beneficial for businesses that prefer to have a consistent repayment schedule for easier budgeting and financial planning.

- Variable: Fluctuates based on market conditions and changes in a reference interest rate, such as the prime rate or the London Interbank Offered Rate (LIBOR). Borrowers with variable rate loans may experience changes in their repayment amounts as rates rise or fall. While variable rates can provide potential cost savings when rates decrease, they can also lead to higher repayments when rates increase.

C. Loan Term

The loan term refers to the length of time over which the borrower is required to repay the loan. Loan terms can range from short-term (a few months) to long-term (several years) and significantly impact the size of loan repayments.

Generally, a longer loan term results in lower repayments spread over a more extended period, while a shorter loan term leads to higher repayments over a shorter period. However, longer loan terms typically result in more interest paid over the life of the loan, increasing the total cost of borrowing.

D. Fees and Charges

In addition to the principal amount and interest rate, various fees and charges can affect the overall cost of business loans and its repayments. Common fees and charges include:

1. Origination Fees: Some lenders charge an origination fee, which is a one-time fee calculated as a percentage of the loan amount. This fee covers the lender’s costs associated with processing, underwriting, and disbursing the loan. Origination fees can either be paid upfront or added to the loan amount, in which case they will affect the overall loan repayments.

2. Prepayment Penalties: Some business loans include prepayment penalties, which are fees charged by the lender if the borrower pays off the loan before the end of the term. These penalties exist to compensate the lender for the lost interest they would have received had the loan been paid off as scheduled. Businesses should consider the potential impact of prepayment penalties when calculating loan repayments and devising an early repayment strategy.

3. Late Payment Fees: Lenders may charge late payment fees if borrowers fail to make their loan repayments on time. These fees can add up quickly and significantly impact the total cost of the loan. To avoid late payment fees, businesses must carefully manage their cash flow and ensure they have enough funds to make timely repayments.

In summary, business loans repayments are affected by several factors, including the principal amount, interest rate, loan term, and various fees and charges. Understanding these factors can help businesses make informed decisions when obtaining

BENEFITS OF USING A BUSINESS LOAN CALCULATOR

A business loan calculator is a valuable tool that can assist businesses in making informed decisions about financing and loan management. By inputting relevant information such as the loan amount, interest rate, loan term, and payment frequency, business owners can gain insights into the potential cost and structure of their loan repayments. There are several benefits to using a business loan calculator, including:

A. Informed Decision-making

A business loan calculator provides businesses with a clear understanding of the financial implications of a loan, enabling them to make well-informed decisions about their financing needs.

By calculating the repayment amounts and interest costs, businesses can assess the affordability of a loan and determine if it aligns with their financial goals and objectives. This knowledge can help businesses avoid taking on loans they cannot afford, reducing the risk of financial distress and default.

B. Budgeting and Financial Planning

Using a business loan calculator can significantly aid businesses in budgeting and financial planning. By understanding the repayment amounts and schedule, business owners can create accurate cash flow projections and allocate funds accordingly to meet their repayment obligations.

This ensures that businesses can maintain smooth operations while managing their loan repayments, ultimately contributing to better overall financial management.

C. Comparing Different Loan Offers

When seeking financing, it’s essential for businesses to compare various loan offers to identify the most suitable and cost-effective option. A business loan calculator can be an invaluable tool in this process.

By inputting the details of different loan offers into the calculator, businesses can easily compare the repayment amounts, interest costs, and total cost of borrowing for each loan. This enables businesses to make well-informed decisions about which loan best aligns with their needs and financial objectives.

D. Identifying Potential Cost Savings

A business loan calculator can also help businesses identify potential cost savings by exploring various scenarios, such as adjusting the loan term or making additional payments.

By understanding the impact of these changes on their loan repayments and interest costs, businesses can develop strategies to minimize their borrowing costs and improve their financial health.

For example, businesses may choose to make additional principal payments to reduce the overall interest paid or refinance their loans to take advantage of lower rates.

A FEW TIPS ON HOW TO HANDLE YOUR BUSINESS LOAN ONCE YOU ARE APPROVEDTIPS

The good news here is that other businesses have been successful with their own business loans and that means all there is to it for any business is to follow a few steps in order to relieve the pressure when it comes to paying off those finances.

TIP # 1 - Always know what your business owes

It pays to make sure that the loan part of the list is detailed, from how much the repayment value is, to when it should be paid, and how much balance does the business have left.

Add up all of these remaining debts in order to see how much the business actually owes. While it may be a bit overwhelming seeing all of the bills that are needed to be paid, trust us, this way the business will get a reminder of what it does owe and knows what it needs to prioritize.

TIP # 2 - Decide on what the business can afford to pay

A business should always know what it can afford to pay towards its obligations. It should ensure that it should not overpay one obligation and leave another obligation or debt hanging in the balance and in danger of being forfeit or delayed. The business should always depend on its cash flow. The money that it is raking in, and also the money that it is shelling out.

This means the business should always have an eye out on its budget and adhere to any strict or stiff budget plan that it should have. List every amount of income that it gets and subtract everything that comes out, making sure that everything stays in the business’ budget.

The business should remember that it should maximize everything and ensure that it would have a bit of savings as well. There are various grants that the Australian Government gives especially during this pandemic, check out if the business is entitled to one.

If a business has more money going out compared to what it is raking in, then it should be time to make hard choices. It should be time to choose what the business needs, or in other words: what the business cannot do without, or what the business wants, or in other terms: what the business can do without at the moment. Reduce and cut down on some expenses that you can identify can be adjusted. Always be realistic when it comes to handling the business budget, make it something that the business can actually stick to. Look for and find ways to save money in order to reduce the business’ spending.

TIP # 3 - The business should learn to prioritize its debts.

A business should be able to work out and prioritize the debts that it should actually pay first. Some of these debts that should be included as the first debts to be paid can be: rent expense, mortgage expenses, corporate fees should the business have any, utility bill which include but are not limited to: electricity bills, transportation bills, water bills, gas bills, phone bills, and internet bills, loan repayments: may it be business loans, a business car loan, or any other loan that the business has.

If somehow the business cannot keep up or are not on top of paying these bills, the business can request for financial assistance for other debts like credit cards, consumer leases, and even payday loans. Australia has a national debt helpline that can give the business a thorough guide that it can use in order to prioritize the debts that it has.

Bizzloans Line of Credit

Business line of credit is often a go-to solution for business owners looking to access sustained, revolving funds from $2,000 — $100,000.

Small Business Loans

Visit Bizzloans Australia

Tools

Bizzloans.co.uk

Help Centre

Create a Support Ticket

Get the funds your business needs to grow with a small business loan from bizzloans.co.uk. We smash our competitor’s rates and have flexible payment terms to suit your business.